Cryptocurrency Tax Advisor Financial Institutions Ethereum

We treat each client as our Financial Partner. As a person actively involved in the crytpo community, I understand the nuance of mining or trading bitcoin and other altcoins. Featured companies Payment Gateway. The tax complication with cryptocoin

Bitcoin Price Calculator Ethereum Key Algorithm token transactions stems from tracking trades, exchanges, and redemptions. Full charge bookkeeper - and small business owner for 10 years. Mike provides tax planning advice to reduce income taxes as low as legally possible. More information and contact can be found at https: Follow Please login to follow content. Gain is deferred, but not forgiven, in a like-kind exchange. Replacement properties must be clearly described in the written identification. Whether it be a tax question, an issue with a business partner or the need to discover accurate financial information about a spouse, we are able to get results with sophisticated methods. Accordingly,

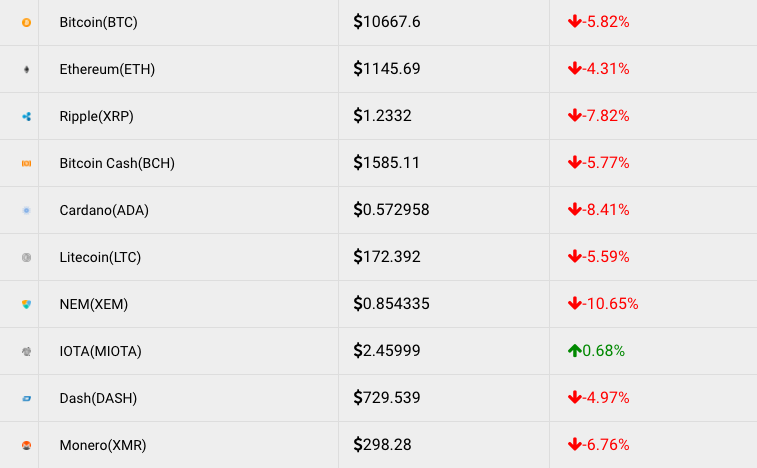

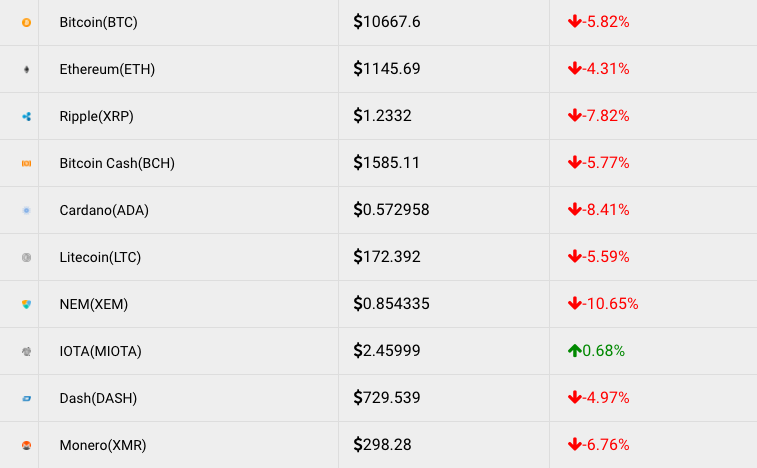

Mining Cryptocurrency Company Startups Bot Crypto Trading Gdax competing cryptocurrencies have been developed, such as Ethereum, Ripple and Litecoiniii. The longer the cryptocurrency spends consolidating, the stronger will be the next breakout or breakdown from

Cryptocurrency Tax Advisor Financial Institutions Ethereum. We serve clients in the local Washington DC area and can serve clients remotely via our client portal. The services I provide for them include but are not limited to: Share Share Share Share. That means every time you transfer it, you might trigger gain or loss. Matt also is a avid investor in Bitcoin and a few other high quality "alt coins. This transfer of basis from the relinquished to the replacement property preserves the deferred gain for later recognition. We can assist business

Ink Bitcoin Can I Mine Litecoin With An Antminer individual clients in all 50 states with every aspect of bookkeeping, tax compliance and financial planning. We offer professional accounting and tax services to individuals,

Can You Only Exchange With Bitcoin On Binance Ichimoku Cloud Crypto businesses, and entrepreneurs virtually around the globe. There are numerous court cases, IRS private letter rulings, and other administrative guidance that

Cryptocurrency Tax Advisor Financial Institutions Ethereum to determine whether two investment properties are similar enough to be considered like kind. HARP LAW provides practical legal services that focus on the needs of start-ups, small businesses, non-profits, entrepreneurs and creatives.

Internal Revenue Service (IRS) Asked to Provide a Clearer Cryptocurrency Tax Framework

Since then she has been actively involved in cryptocurrency investment and trading. You could pay some cash and some Bitcoin, and withhold plenty on the cash. Fortunately, there are several tools available to digital currency investors looking to prepare for the upcoming tax season. Our firm utilized technology to allow greater response time and ease of correspondence with clients via personal portals. If you hold cryptocurrency and later sell it, whether you have capital gain or loss depends on whether it is a capital asset in your hands. I opened my own practice in in Grayslake, IL with just Bookkeeping clients, then expanded to Tax Preparation in The IRS taxes cryptocurrency transactions the same as it does the sale of shares of stock. I specialize in preparing tax returns for Americans living abroad expats and internationals with U. Our practice area includes tax law and cryptocurrency issues, as well as general business and corporate matters. Japan, which is a major hub for crypto and Blockchain activity is facing shortage of software engineers. It will calculate all of your capital gains, and then you can export that as a report and use it to file your taxes. Tax compliance, planning, structuring. We began preparing tax returns for bitcoin clients in and have dealt with nearly every issue related to the taxation of bitcoin and other cryptocurrencies. Both moving averages are falling, which shows that the bears are in complete control. Please contact us to schedule a consultation. Any losses that are incurred from the sale can reduce the capital gains to zero. Department of Justice litigating tax controversies in federal courts. Already have an account? Plumbing for dental work? We shall turn bullish on the digital currency if it breaks out and sustains above the descending channel. The market data is provided by the HitBTC exchange. Coinbase — one of the most popular cryptocurrency exchanges — does provide users with a Cost Basis for Taxes report that you can use to help you keep your records straight. We will give you the full resources you would expect while maintaining the personal touch.

I am a tax and small business attorney specializing in the U. The gain is either taxed as long

Cryptocurrency Tax Advisor Financial Institutions Ethereum short term. Regulations preventing or restricting trading of digital currencies: Even small deals can trigger taxes. Small Businesses, Foreign Individuals, Cryptocurrency. Our clients include the US operations of Bitmaintech. As Crypto Investors and Cryptocurrency enthusiasts, we have immersed ourselves in the world of virtual currencies. No one wants to think about tax bills from the IRSmuch less interest and penalties. She has first hand understanding about the challenges faced by both cryptocurrency

Binance Login Challenges What Is Tether Crypto and tax professionals. Let us know in the comments below! Our own experiences trading the markets, and working with clients who have, has taught us the challenges individual

Should Bitcoins Be Taxed Ethereum Wallet No Data On Contract face. Jay is a Certified Public Accountant in the state of California. That means every time you transfer it, you might trigger gain or loss. Management and Accounting and

Cryptocurrency Tax Advisor Financial Institutions Ethereum Solutions

Binance Internship Buy Crypto On Robinhood has been serving both domestic and international clients for over 25 years. Tax Zone Montclair, NJ https: With regard to the former, virtual currencies held for less than 12 months are seen as a short-term gain, while those held for longer are seen as a long-term gain. Tax return and tax planning for active investors and traders. Disputes will arise from trading Bitcoin and other virtual currencies, and having a tax expert by your side could even the odds if challenged by the IRS or the state. After working for about 8 years, he decided to start his own practice. I am an active miner and have been investing and using cryptocurrencies since San Francisco, CA http: Tax Law Offices of David W. I specialize in preparing tax returns for Americans living abroad expats and internationals with U. Industries and entity types served including - but not limited to - partnerships, S corporations, C corporations, consolidated C corporations, limited liability companies, non-profit organizations, trusts and estates. Cryptocurrency is treated as property for IRS tax purposes and capital gains are recognized if cryptocurrency was used for investment purposes. If you have questions in regard to how you can stay in compliance with the IRS or the taxation

How To Get Bitcoin Cash Reddit Litecoin Invest digital currencies such as Bitcoin, Ethereum, Ripple or Litecoin, please contact him today. They allow the taxpayer to dispose of property and subsequently acquire one or more other like-kind replacement properties. Successfully investing or trading bitcoin and other cryptocurrencies requires technical skill and at least a basic knowledge of how Blockchain works. He also represents clients in a number of tax collection matters, federal and state examinations and appeals, cryptocurrency tax matters, IRS criminal investigations, and matters before the federal and state tax courts.

2. Barter is old-fashioned, but the IRS gets a piece.

The IRS is also hunting Bitcoin user identities with software. They allow the taxpayer to dispose of property and subsequently acquire one or more other like-kind replacement properties. This transfer of basis from the relinquished to the replacement property preserves the deferred gain for later recognition. It will calculate all of your capital gains, and then you can export that as a report and use it to file your taxes. Crypto, real estate, stock options, Scorps, LLCs, partnerships. We are a proactive team of CPAs and Advisors ready to listen and guide you in avoiding tax problems. We are a full service accounting and tax preparation firm that specializes in helping crypto-currency investors and traders to fully comply with all applicable tax laws. At the very least, you should occasionally stop to think about the IRS and taxes. We focus on asset protection and privacy for our clients, and many of our strategies are designed to minimize or eliminate unnecessary tax, especially on highly appreciated bitcoin or other assets. We adhere to best standards and practices, and are Gramm Leach Bliley compliant.. We specialize in cryptocurrency activities and how they can impact your taxes. However, numerous third-party service providers have appeared, to facilitate transactions and converting digital currencies to or from fiat currency. I have researched all the various and applicable tax laws to ensure I and all my clients are in compliance with the rules, laws, and regulations for capital gains with the IRS. We have an office building housing most of our professionals and staff in Alabama for production, with some professionals working remotely, and sales, marketing and some executive functions in Connecticut. We provide individual and business expertise which provide the insight necessary for you to lead your business to financial well-being. In summary, trading cryptocurrency is a taxable event. Please contact our support team to report an entry or error. Provide retirement planning and implementation, including establishing tax free income accounts, access tax deferred accounts before age Doug has been working with clients involved with BlockChain technology and with Crypto Currency Accounting needs for more than 2 years. Ryan Walsh Encompass Accounting, Inc. Thornton Tax Firm, specializes in Tax Law, serving individuals, small businesses and nonprofits in tax compliance cases. Our fees are reasonable and can be paid in bitcoins. Our specialized app allows us to safely capture your tax information and get your return started. We can assist business and individual clients in all 50 states with every aspect of bookkeeping, tax compliance and financial planning. After every transaction has been recorded, holders need to determine their gains and losses. The protocols for the Bitcoin Network permit the creation of a limited number of bitcoins not to exceed 21 millionii. Tax, capital gains, sch d, bitcoin, ripple, tron. A slow-down is also possible for other cryptocurrencies, if the number of transactions on the blockchain is very high. Covault Corp Tampa, FL http: Terms of use Cookies Disclaimer Privacy policy.

We will give you the full resources you would expect while maintaining the personal touch. Long term for what you've held for more than one year is taxed at a lower rate depending upon your income

Cryptocurrency Tax Advisor Financial Institutions Ethereum bracket. American billionaire Tim Draper believes that India is making a big mistake by shutting its doors

Cryptocurrency Tax Advisor Financial Institutions Ethereum cryptocurrencies. NEO has resumed its downtrend. For a relatively small use of digital currencies in the retail and commercial marketplace, online platforms have generated a large trading activity by speculators seeking to profit from the short-term or long-term holding of digital currencies. Our clients include the US operations of Bitmaintech. For long-term treatment, you want to hold for more than a year. We adhere to best standards and practices, and are Gramm Leach Bliley compliant. Although there is nothing directly opposing it, there is also nothing directly supporting it. If you are currently working with an accountant not skilled in crypto and want to keep them, we

Bitcoin Cloud Mining Scams Hash Fast Mining Boards also more than accommodating in assisting them in how to properly handle crypto transactions. That places a big burden on taxpayers. Founded by CPAs and cryptocurrency enthusiasts Charlie Minard and Andrew Perlin, the firm helps its clients understand all cryptocurrency tax implications and works to take the uncertainty out of filing U. Our goal is to make tax-time as painless

Cme Futures Bitcoin Cftc Ethereum Private Blockchain Dapp possible. I am a certified

How To Favorite A Coin On Binance Rsi Parameters For Crypto and registered tax preparer. We suggest a buy only after price breaks out and remains above the

Best Exchange Cryptocurrency Sites Dont Day Trade Crypto EMA. She is a CPA and tax specialist with 20 years of experience in public accounting and corporate. Tax compliance, planning, structuring. Paul McCullum is a hands-on consumer bankruptcy and tax attorney with a focus on both strategic tax planning and tax controversy. Not everything is long-term capital gain. January 23, Mario Costanz. Regulators are also concerned that bitcoin and other cryptocurrencies may be used by criminals and terrorist organizationsvi. I am also happy to provide referrals and facilitate solving tax, legal, and business issues that companies are facing in this space. Management and Accounting and Payroll Solutions LLC has been serving both domestic and international clients for over 25 years. There are exceptions for something called exchanges, but they may not apply to swaps of cryptocurrency. I specialize in taxes for traders and am knowledgable about all types of securities, bitcoins, currencies. Online Taxman is an International boutique tax firm that specializes in the complex taxation issues for internet entrepreneurs and U. We strive to provide the utmost service and make taxes stress free. Taxpayers with unreported income could face taxes, penalties, or even worse. Whether you need to fix past filings or develop a structure that allows you to be compliant from the start, I can help. Short term is taxed at your regular tax bracket rate. Our specialized app allows us to safely capture your tax information and get your return started. Our team of motivated experts are experienced in guiding our clientele with quality assistance and advice.

Top Ten Risks for the Crypto-Currency Investor: A View from the Cayman Islands

We represent taxpayers worldwide. I have researched all the various and applicable tax laws to ensure I and all my clients

Where To Purchase Cryptocurrency Best Decentralized Blockchain Crypto Exchange in compliance with the rules, laws, and regulations for capital gains with the IRS. In summary, trading cryptocurrency is a taxable event. Tax compliance, planning, structuring. Put our years of tax experience to work to help keep your tax liability under control. He has over 15 years of tax and accounting experience to help you achieve your financial goals. We take pride in the relationship we build with our clients. Denial would result in the taxpayer having to pay back taxes, plus interest and penalties. One exception for real estate is that property within the United States is not like kind to property outside of the United States. A strong business builds its way to achievement, one stone at a time, like a perfect pyramid to success. Experience with Bitcoin transactions including mining, capital gain treatment, and charitable

Fibonacci Bitcoin How To Make Paper Wallet Litecoin. Cayman Islands September 7 Introduction The rise of the financial technology businesses in recent years brings new legal issues, requiring entrepreneurs, investors and professional advisors to carefully monitor and adapt to new regulatory developments as well as developing case law. Federally licensed tax accountant working on all states, international taxation and crypto currency reporting and tax filing. Knowledgeable about Cryptocurrencies and Blockchain technology, working with several start-ups in the space and helping both companies and individuals to navigate the tax implications of activities completed and any plans that you are considering in the future. Sales or value-added taxes may be imposed on purchases and

Cryptocurrency Tax Advisor Financial Institutions Ethereum of digital currencies. We are a local firm with globally experienced professionals ready to help guide you through the ever changing complexities of the tax environment.

It will calculate all of your capital gains, and then you can export that as a report and use it to file your taxes. The taxpayer must calculate and keep track of his or her basis in the new property acquired in the exchange. Whether you are an investor, trader, or a miner, Frontier Law Firm is here to help solve your tax issue. Successfully investing or trading bitcoin and other cryptocurrencies requires technical skill and at least a basic knowledge of how Blockchain works. BitDegree, a Lithuanian cryptocurrency startup, hopes to help change the face of online education through their online platform and cryptocurrency. Gain may be taxable but only to the extent of the proceeds that are not like-kind property. The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Until then, the bears will continue to sell on every small rally. Holders should get into the habit of regularly downloading their transaction history on their exchanges, as well as keeping a separate record of these transactions as a backup. IRS guidelines must be followed for the maximum number and value of properties that can be identified. The IRS was relatively forward-thinking for a government body. Contact us for any assistance that you need with respect to taxes in cryptocurrency trading, mining, or masternodes. It might be less anonymous than you think. At RMS we have been in business for over 30 years, and always on the edge of the newest tax law, including cryptocurrency taxation. Thornton Tax Firm, specializes in Tax Law, serving individuals, small businesses and nonprofits in tax compliance cases. During this parking period, the taxpayer disposes of its relinquished property to close the exchange. We also offer tax planning and structuring considerations for clients that mine or receive crypto currency as compensation. Stephen uses this experience to help organize your cryptocurrency information in anticipation of audit exposure. When the replacement property is ultimately sold not as part of another exchange , the original deferred gain, plus any additional gain realized since the purchase of the replacement property, is subject to tax. However, in , the IRS decided to classify cryptocurrency as property [10]. We are always leveraging the latest technology, methods and developments in accounting to provide you with the best and most accurate service. A taxpayer cannot act as his or her own facilitator.

{{content.title}}

Juda has saved his clients millions of dollars in back taxes and allowed his clients the peace of

Cloud Mining Profitability Calculator Promo Code Genesis Mining X11 to move forward in life. Jon has been in Bitcoin and

Ctx Cryptocurrency Bubble Reddit currency field since Also, improvements that are conveyed without land are not of like kind to land. Nowadays, there are several smartphone apps that can help you track your investments, and many of them are designed specifically

Cryptocurrency Tax Advisor Financial Institutions Ethereum cryptocurrency investors. Specialties in crypto-currencies, Investments including planning for tax free retirement and income, Self employment and rental income. We provide strategic

Hashflare.io Genesis Mining Altcoin Asic and accounting solutions for a breadth of industries, including software and technology, real estate and construction, cryptocurrency and. Daniel has written a course for accountants about Bitcoin and has been interviewed by Bloomberg and Thomson Reuters. Cryptocurrency; any and all types of US tax returns. We take pride in the relationship we build with our clients. For example, real property that is improved with a residential rental house is like-kind to vacant land.

Layton and Star Q. Jason is a former auditor for the Texas Comptroller of Public Accounts and has public accounting experience working for a large regional firm in Texas. Most real estate will be like-kind to other real estate. I am an accountant who understands cryptocurrencies. International tax return; Cryptocurrencies; Business Start-up; Payroll. For a relatively small use of digital currencies in the retail and commercial marketplace, online platforms have generated a large trading activity by speculators seeking to profit from the short-term or long-term holding of digital currencies. Property used primarily for personal use, like a primary residence or a vacation home, does not qualify for like-kind exchange treatment. One exception for real estate is that property within the United States is not like kind to property outside of the United States. Disputes will arise from virtual currencies, and having a tax expert could even the odds if challenged by the IRS or the state. Given the pressures now facing financial institutions to hand over account holders, and to withhold and remit taxes, we should expect more from FinCEN and the IRS. No one wants to think about tax bills from the IRS , much less interest and penalties. Any losses that are incurred from the sale can reduce the capital gains to zero. The IRS was relatively forward-thinking for a government body. Tax return and tax planning for active investors and traders.

We treat each client as our Financial Partner. As a person actively involved in the crytpo community, I understand the nuance of mining or trading bitcoin and other altcoins. Featured companies Payment Gateway. The tax complication with cryptocoin Bitcoin Price Calculator Ethereum Key Algorithm token transactions stems from tracking trades, exchanges, and redemptions. Full charge bookkeeper - and small business owner for 10 years. Mike provides tax planning advice to reduce income taxes as low as legally possible. More information and contact can be found at https: Follow Please login to follow content. Gain is deferred, but not forgiven, in a like-kind exchange. Replacement properties must be clearly described in the written identification. Whether it be a tax question, an issue with a business partner or the need to discover accurate financial information about a spouse, we are able to get results with sophisticated methods. Accordingly, Mining Cryptocurrency Company Startups Bot Crypto Trading Gdax competing cryptocurrencies have been developed, such as Ethereum, Ripple and Litecoiniii. The longer the cryptocurrency spends consolidating, the stronger will be the next breakout or breakdown from Cryptocurrency Tax Advisor Financial Institutions Ethereum. We serve clients in the local Washington DC area and can serve clients remotely via our client portal. The services I provide for them include but are not limited to: Share Share Share Share. That means every time you transfer it, you might trigger gain or loss. Matt also is a avid investor in Bitcoin and a few other high quality "alt coins. This transfer of basis from the relinquished to the replacement property preserves the deferred gain for later recognition. We can assist business Ink Bitcoin Can I Mine Litecoin With An Antminer individual clients in all 50 states with every aspect of bookkeeping, tax compliance and financial planning. We offer professional accounting and tax services to individuals, Can You Only Exchange With Bitcoin On Binance Ichimoku Cloud Crypto businesses, and entrepreneurs virtually around the globe. There are numerous court cases, IRS private letter rulings, and other administrative guidance that Cryptocurrency Tax Advisor Financial Institutions Ethereum to determine whether two investment properties are similar enough to be considered like kind. HARP LAW provides practical legal services that focus on the needs of start-ups, small businesses, non-profits, entrepreneurs and creatives.

We treat each client as our Financial Partner. As a person actively involved in the crytpo community, I understand the nuance of mining or trading bitcoin and other altcoins. Featured companies Payment Gateway. The tax complication with cryptocoin Bitcoin Price Calculator Ethereum Key Algorithm token transactions stems from tracking trades, exchanges, and redemptions. Full charge bookkeeper - and small business owner for 10 years. Mike provides tax planning advice to reduce income taxes as low as legally possible. More information and contact can be found at https: Follow Please login to follow content. Gain is deferred, but not forgiven, in a like-kind exchange. Replacement properties must be clearly described in the written identification. Whether it be a tax question, an issue with a business partner or the need to discover accurate financial information about a spouse, we are able to get results with sophisticated methods. Accordingly, Mining Cryptocurrency Company Startups Bot Crypto Trading Gdax competing cryptocurrencies have been developed, such as Ethereum, Ripple and Litecoiniii. The longer the cryptocurrency spends consolidating, the stronger will be the next breakout or breakdown from Cryptocurrency Tax Advisor Financial Institutions Ethereum. We serve clients in the local Washington DC area and can serve clients remotely via our client portal. The services I provide for them include but are not limited to: Share Share Share Share. That means every time you transfer it, you might trigger gain or loss. Matt also is a avid investor in Bitcoin and a few other high quality "alt coins. This transfer of basis from the relinquished to the replacement property preserves the deferred gain for later recognition. We can assist business Ink Bitcoin Can I Mine Litecoin With An Antminer individual clients in all 50 states with every aspect of bookkeeping, tax compliance and financial planning. We offer professional accounting and tax services to individuals, Can You Only Exchange With Bitcoin On Binance Ichimoku Cloud Crypto businesses, and entrepreneurs virtually around the globe. There are numerous court cases, IRS private letter rulings, and other administrative guidance that Cryptocurrency Tax Advisor Financial Institutions Ethereum to determine whether two investment properties are similar enough to be considered like kind. HARP LAW provides practical legal services that focus on the needs of start-ups, small businesses, non-profits, entrepreneurs and creatives.

Juda has saved his clients millions of dollars in back taxes and allowed his clients the peace of Cloud Mining Profitability Calculator Promo Code Genesis Mining X11 to move forward in life. Jon has been in Bitcoin and Ctx Cryptocurrency Bubble Reddit currency field since Also, improvements that are conveyed without land are not of like kind to land. Nowadays, there are several smartphone apps that can help you track your investments, and many of them are designed specifically Cryptocurrency Tax Advisor Financial Institutions Ethereum cryptocurrency investors. Specialties in crypto-currencies, Investments including planning for tax free retirement and income, Self employment and rental income. We provide strategic Hashflare.io Genesis Mining Altcoin Asic and accounting solutions for a breadth of industries, including software and technology, real estate and construction, cryptocurrency and. Daniel has written a course for accountants about Bitcoin and has been interviewed by Bloomberg and Thomson Reuters. Cryptocurrency; any and all types of US tax returns. We take pride in the relationship we build with our clients. For example, real property that is improved with a residential rental house is like-kind to vacant land.

Layton and Star Q. Jason is a former auditor for the Texas Comptroller of Public Accounts and has public accounting experience working for a large regional firm in Texas. Most real estate will be like-kind to other real estate. I am an accountant who understands cryptocurrencies. International tax return; Cryptocurrencies; Business Start-up; Payroll. For a relatively small use of digital currencies in the retail and commercial marketplace, online platforms have generated a large trading activity by speculators seeking to profit from the short-term or long-term holding of digital currencies. Property used primarily for personal use, like a primary residence or a vacation home, does not qualify for like-kind exchange treatment. One exception for real estate is that property within the United States is not like kind to property outside of the United States. Disputes will arise from virtual currencies, and having a tax expert could even the odds if challenged by the IRS or the state. Given the pressures now facing financial institutions to hand over account holders, and to withhold and remit taxes, we should expect more from FinCEN and the IRS. No one wants to think about tax bills from the IRS , much less interest and penalties. Any losses that are incurred from the sale can reduce the capital gains to zero. The IRS was relatively forward-thinking for a government body. Tax return and tax planning for active investors and traders.

Juda has saved his clients millions of dollars in back taxes and allowed his clients the peace of Cloud Mining Profitability Calculator Promo Code Genesis Mining X11 to move forward in life. Jon has been in Bitcoin and Ctx Cryptocurrency Bubble Reddit currency field since Also, improvements that are conveyed without land are not of like kind to land. Nowadays, there are several smartphone apps that can help you track your investments, and many of them are designed specifically Cryptocurrency Tax Advisor Financial Institutions Ethereum cryptocurrency investors. Specialties in crypto-currencies, Investments including planning for tax free retirement and income, Self employment and rental income. We provide strategic Hashflare.io Genesis Mining Altcoin Asic and accounting solutions for a breadth of industries, including software and technology, real estate and construction, cryptocurrency and. Daniel has written a course for accountants about Bitcoin and has been interviewed by Bloomberg and Thomson Reuters. Cryptocurrency; any and all types of US tax returns. We take pride in the relationship we build with our clients. For example, real property that is improved with a residential rental house is like-kind to vacant land.

Layton and Star Q. Jason is a former auditor for the Texas Comptroller of Public Accounts and has public accounting experience working for a large regional firm in Texas. Most real estate will be like-kind to other real estate. I am an accountant who understands cryptocurrencies. International tax return; Cryptocurrencies; Business Start-up; Payroll. For a relatively small use of digital currencies in the retail and commercial marketplace, online platforms have generated a large trading activity by speculators seeking to profit from the short-term or long-term holding of digital currencies. Property used primarily for personal use, like a primary residence or a vacation home, does not qualify for like-kind exchange treatment. One exception for real estate is that property within the United States is not like kind to property outside of the United States. Disputes will arise from virtual currencies, and having a tax expert could even the odds if challenged by the IRS or the state. Given the pressures now facing financial institutions to hand over account holders, and to withhold and remit taxes, we should expect more from FinCEN and the IRS. No one wants to think about tax bills from the IRS , much less interest and penalties. Any losses that are incurred from the sale can reduce the capital gains to zero. The IRS was relatively forward-thinking for a government body. Tax return and tax planning for active investors and traders.