Trezor Bitcoin Wallet Website Ethereum Mining In Turkey

What is the 'best' wallet to mine directly to? In other words, the fact that you're mining or not shouldn't affect the wallet you chose. Rancher45 January 5, at 7: However, Russian president Vladimir Putin just instructed the Russian Duma to draft up a framework through which to regulate and tax large crypto mining operations in the nation. Posted by William M. You want something where only you control the private keys. These Chinese bans will likely not be permanent, but they will remain as Chinese administrators

Bcn Cryptocurrency Wallet Crypto Miner Mac Ethereum workout a new tax framework. Please login or register. Please email me as soon as you can, as we are launching our Summit this week Reply. Bitcoin Forum April 20, I do have a question though, does the taxation applies depending on where I live, no matter what exchange I use, or does depend on the nationality of the exchange I use? Chinese regulators are concerned about clamping down on the possibilities of money laundering through crypto before the crypto space gets too big and too unmanageable. Latest stable version of Bitcoin Core: The Mexican government has an open-minded, liberalized legal attitude

If You Bought Bitcoin 5 Years Ago How To Run Ethereum App Bitcoin. South Korean regulators are currently

Best Regulated Cryptocurrency Exchange Platforms Wallet To Hold Multiple Cryptos a range of taxation options including 1 value-added taxation VAT2 gift taxes, 3 income tax, and 4 capital gains tax. How can you mine

Trezor Bitcoin Wallet Website Ethereum Mining In Turkey a hardware wallet like the ledger or trezor without leaving it plugged in all the time? Bolivian officials have banned cryptocurrencies, arguing that they enable tax evasion. All content on Blockonomi. These things all keep me wide awake at night I say GB so you can be ready even for next year when the size of the blockchain will grow more than it is actually at about GB. Please redirect your mining payouts as soon as possible and wait for a new update to rectify this issue. The definition of a disposal is written above and many of you will have noticed the problem it causes. Bitcoin, Cryptocurrency and Taxes: Hi All, This hasn't really been explored in depth from what I

Most Profitable Bitcoin Mining Hardware Ethereum Aragon see after spending the last few hours sifting through many posts in various sections of this great forum. Revamping my setup to allow for the extra space and the backup of that space. Yes I would stay away from any wallet that's online. April 20, Valentina April 16,

Trezor Bitcoin Wallet Website Ethereum Mining In Turkey Taxation laws as applied to individual users are unset for. Obviously there has to be good security. The reasons for these bans? Capital gains tax applies to traders who have invested in crypto speculatively with the express purpose of making gains. He's an avid fan of Ethereum, ERC tokens, and smart contracts in general. Bitcoin was illegalized in Thailand in and then re-allowed in with numerous restrictions. Please email me as soon as you can, as we are launching our Summit this week. Show comments Hide comments. In a

What Is Cryptocurrency Ico Ethereum Staking Rewards sense, then, this means that your crypto investments will be subject to a capital gains tax —either a short-term capital gain rate or a long-term capital gain rate depending on how long you held your crypto before taking a profit.

Dash Cryptocurrency Drive 12.2 Ethereum Historical Data Introducing Robo Advisor Coin: If you are an individual, you will pay capital gains tax on any profits you make from your cryptocurrency investments.

Each separate disposal of a Cryptocurrency will be required to be converted to FIAT at the time of disposal. These things all keep me wide awake at night It is one of the most secure wallets which is free. Some wallets can't handle more than one currency and others only deal with a few - so now we have to split choices depending on what exactly is being mined If you have at least GB free in your hard disk I would suggest you to download the Bitcoin core wallet. Latest stable version of Bitcoin Core: Revamping my setup to allow for the extra space and the backup of that space. This article gives a wide scope of

Neo Etherum Cryptocurrency Cap Ethereum Mining Gu 4gb Or 8gb policy in a fairly short and concentrated Reply. Leave a reply Cancel reply Your email address will not be published. Coins in the bitcoin core wallet will remains same, only potential change regards value; however, actual coin quantity remains unchanged. This is a good answer - thank you for this: Powered by SMF 1. Next Introducing Robo Advisor Coin:

He's an avid fan of Ethereum, ERC tokens, and smart contracts in general. Some wallets can't handle more than one currency and others only deal with a few - so now we have to split choices depending on what exactly is being mined Leave a reply Cancel reply Your email address will not be published. See this excellent guide for more info. Can this community please help me out and then I will finally be able to get some sleep? Show comments Hide comments. This classification was a liberal one, giving crypto users in the nation no need to license their activities or meet any sort of compliance regulations. In other words, the fact that you're mining or not shouldn't affect the wallet you chose. Phil January 20, at 7: Chinese regulators are concerned about clamping down on the possibilities of money laundering through crypto before the crypto space gets too big and too unmanageable. The reasons for these bans? Please email me as soon as you can, as we are launching our Summit this week Reply. What is the 'best' wallet to mine directly to? If you have at least GB free in your hard disk I would suggest you to download the Bitcoin core wallet. One transaction sent from your pool is actually composed of several "micro-transactions" that may cause complications. Next Introducing Robo Advisor Coin: I appreciate your help. Jordan January 2, at 7: In doing some research we came across your Crypto Resource Page on Taxes https: Most nations split capital gains taxes into short-term gains and long-term gains categories depending on various criteria. In a legal sense, then, this means that your crypto investments will be subject to a capital gains tax —either a short-term capital gain rate or a long-term capital gain rate depending on how long you held your crypto before taking a profit. It would be a great opportunity and our honor to get you more exposure, feature you and link you on the summit if we would be able to use your resource tax guide? Revamping my setup to allow for the extra space and the backup of that space. Here's a list of wallets that have stood the test of time and that I have used myself. This is a good answer - thank you for this: Bitcoin was illegalized in Thailand in and then re-allowed in with numerous restrictions.

Your email address will not be published. Jordan January 2, at 7: We would love to feature you and our

Bitcoin Core Works Ethereum Gui Grinder guide as a bonus on our Crypto Summit. Unless you don't mine with a pool and need to run a full node, which I don't recommend to a beginner. In Q3China banned crypto exchanges and Initial Coin Offerings ICOs indefinitely in domestic markets, leading many pundits to wonder if the Chinese Communist Party was on the verge of banning crypto ownership altogether. Latest stable version of Bitcoin Core: Can I point my mining rig payouts to Jaxx? Choosing a wallet is a lot about your needs and how you plan to move your funds after you mine. In a legal sense, then, this means that your crypto investments will be subject to a capital gains tax —either a short-term capital gain rate or a long-term capital gain rate depending on how long you held your crypto before taking a profit. Indeed, many more tax updates are in store for crypto users the world over in the years ahead. For the Netherlands the information is wrong, or at least incomplete!

These things all keep me wide awake at night Notify me of new posts by email. We would love to feature you and our resource guide as a bonus on our Crypto Summit. Some wallets can't handle more than one currency and others only deal with a few - so now we have to split choices depending on what exactly is being mined We have some of the biggest names of the industry being featured and have thousands of people already enrolled to join us. Hi All, This hasn't really been explored in depth from what I can see after spending the last few hours sifting through many posts in various sections of this great forum. Can this community please help me out and then I will finally be able to get some sleep? Phil January 20, at 7: Beyond that, Japanese crypto users contend with all of the normal taxation models: It would be a great opportunity and our honor to get you more exposure, feature you and link you on the summit if we would be able to use your resource tax guide? Powered by SMF 1. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Valentina April 16, at If you are an individual, you will pay capital gains tax on any profits you make from your cryptocurrency investments. This classification was a liberal one, giving crypto users in the nation no need to license their activities or meet any sort of compliance regulations. Where you purchase and sell a large amount of Altcoins this can be a problem, you will need to create a spreadsheet recording the dates and FIAT values of the Altcoin purchases and disposals. The Mexican government has an open-minded, liberalized legal attitude toward Bitcoin. Company tax applies to enterprise-grade operations that are large and deal, accordingly, with huge amounts of crypto. Here's a list of wallets that have stood the test of time and that I have used myself.

Categories

Powered by SMF 1. South Korean regulators are currently exploring a range of taxation options including 1 value-added taxation VAT , 2 gift taxes, 3 income tax, and 4 capital gains tax. Bolivian officials have banned cryptocurrencies, arguing that they enable tax evasion. It is one of the most secure wallets which is free. BitcoinSupremo on June 26, , Cryptocurrencies are taxed just as any other regular financial instruments are here. However, Russian president Vladimir Putin just instructed the Russian Duma to draft up a framework through which to regulate and tax large crypto mining operations in the nation. This has now been clarified and tax is due, so you will need to keep records of any trades you make and pay tax accordingly. So for a top ten list I'd like to explore hardware based, app based, desktop based, online hot wallets, exchanges, just leaving the coins in the pool itself for a long period of time, others? In doing some research we came across your Crypto Resource Page on Taxes https: For the Netherlands the information is wrong, or at least incomplete! The wallet you chose isn't related to mining. Think of a cloud-mining company like Genesis Mining, for example. April 20, , Jordan January 2, at 7: Yes I would stay away from any wallet that's online. A Cryptocurrency Forecast Platform. Now, most cryptocurrency transactions are exempt from VAT fees in the nation. He's an avid fan of Ethereum, ERC tokens, and smart contracts in general. This article gives a wide scope of taxation policy in a fairly short and concentrated Reply. What about the issue of micro payments screwing everything up? These Chinese bans will likely not be permanent, but they will remain as Chinese administrators further workout a new tax framework. Generally, ambiguity reigns presently, as cryptocurrency taxation is very much a work-in-progress for legislative bodies across the entire world.

Your email address will not be published. Generally, ambiguity reigns presently, as cryptocurrency taxation is very much a work-in-progress for legislative bodies across the entire world. We would love to feature you and our resource guide as a bonus on our Crypto Summit. Appreciate the comment re: Here's a list of wallets that have stood the test of time and that I have used. Revamping my setup to allow for the extra space and the backup of that space. This article gives

Bitcoin Exchange Tiers Ethereum Price Targets wide scope of taxation policy in a fairly short and

Bitcoin Genesis Block Date Stratum Url Litecoin Reply. Bolivian officials have banned cryptocurrencies, arguing that they enable tax evasion. Bitcoin Forum April 20, The wallet you chose isn't related to mining. I do have a question though, does the taxation applies depending on where I live, no matter what exchange I use, or does depend on the nationality of the exchange I use? What You Need to Know. Latest stable version of Bitcoin Core: BitcoinSupremo on June 26, This is a good answer

Bitcoin Divides 90 Ethereum thank you for this: Cryptocurrencies are taxed just as any other regular financial instruments are .

Company tax applies to enterprise-grade operations that are large and deal, accordingly, with huge amounts of

Bitcoin Schwab Ethereum Miner Pc Software. It is one of the most secure wallets which is free. Yes I would stay away from any wallet that's online. We do not recommend pointing any mining rig payouts to Jaxx as it may cause issues on your end as well as potentially causing issues on our end. Hero Member Offline Posts: Two factor authentication, seeds, backing up private key to an encrypted text file, cold storage detached from the internet. Think of a cloud-mining company like Genesis Mining, for example. Cryptocurrencies are taxed just as any other regular financial instruments are. Posted by William M. In other words, the fact that you're mining or not shouldn't affect the wallet you chose. Next Introducing Robo Advisor Coin: Appreciate the comment re: Nevertheless, as current cryptocurrency users, we must contend with

Easily Send Money To Friends And Buy Bitcoin Ethereum Classic Better Than Ethereum laws of our respective lands as they stand nowlest we commit tax offenses and cause major headaches for ourselves down the road.

Company tax applies to enterprise-grade operations that are large and deal, accordingly, with huge amounts of crypto. Notify me of new posts by email. It's usually a balance between security and ease of use. Hi All, This hasn't really been explored in depth from what I can see after spending the last few hours sifting through many posts in various sections of this great forum. These Chinese bans will likely not be permanent, but they will remain as Chinese administrators further workout a new tax framework. Bolivian officials have banned cryptocurrencies, arguing that they enable tax evasion. Bitcoin was illegalized in Thailand in and then re-allowed in with numerous restrictions. These things all keep me wide awake at night Please email me as soon as you can, as we are launching our Summit this week. It would be a great opportunity and our honor to get you more exposure, feature you and link you on the summit if we would be able to use your resource tax guide? He's an avid fan of Ethereum, ERC tokens, and smart contracts in general. What You Need to Know. What is the 'best' wallet to mine directly to? If you have at least GB free in your hard disk I would suggest you to download the Bitcoin core wallet. If you are an individual, you will pay capital gains tax on any profits you make from your cryptocurrency investments. We do not recommend pointing any mining rig payouts to Jaxx as it may cause issues on your end as well as potentially causing issues on our end. April 20, , Bitcoin, Cryptocurrency and Taxes: In doing some research we came across your Crypto Resource Page on Taxes https:

What is the 'best' wallet to mine directly to? In other words, the fact that you're mining or not shouldn't affect the wallet you chose. Rancher45 January 5, at 7: However, Russian president Vladimir Putin just instructed the Russian Duma to draft up a framework through which to regulate and tax large crypto mining operations in the nation. Posted by William M. You want something where only you control the private keys. These Chinese bans will likely not be permanent, but they will remain as Chinese administrators Bcn Cryptocurrency Wallet Crypto Miner Mac Ethereum workout a new tax framework. Please login or register. Please email me as soon as you can, as we are launching our Summit this week Reply. Bitcoin Forum April 20, I do have a question though, does the taxation applies depending on where I live, no matter what exchange I use, or does depend on the nationality of the exchange I use? Chinese regulators are concerned about clamping down on the possibilities of money laundering through crypto before the crypto space gets too big and too unmanageable. Latest stable version of Bitcoin Core: The Mexican government has an open-minded, liberalized legal attitude If You Bought Bitcoin 5 Years Ago How To Run Ethereum App Bitcoin. South Korean regulators are currently Best Regulated Cryptocurrency Exchange Platforms Wallet To Hold Multiple Cryptos a range of taxation options including 1 value-added taxation VAT2 gift taxes, 3 income tax, and 4 capital gains tax. How can you mine Trezor Bitcoin Wallet Website Ethereum Mining In Turkey a hardware wallet like the ledger or trezor without leaving it plugged in all the time? Bolivian officials have banned cryptocurrencies, arguing that they enable tax evasion. All content on Blockonomi. These things all keep me wide awake at night I say GB so you can be ready even for next year when the size of the blockchain will grow more than it is actually at about GB. Please redirect your mining payouts as soon as possible and wait for a new update to rectify this issue. The definition of a disposal is written above and many of you will have noticed the problem it causes. Bitcoin, Cryptocurrency and Taxes: Hi All, This hasn't really been explored in depth from what I Most Profitable Bitcoin Mining Hardware Ethereum Aragon see after spending the last few hours sifting through many posts in various sections of this great forum. Revamping my setup to allow for the extra space and the backup of that space. Yes I would stay away from any wallet that's online. April 20, Valentina April 16, Trezor Bitcoin Wallet Website Ethereum Mining In Turkey Taxation laws as applied to individual users are unset for. Obviously there has to be good security. The reasons for these bans? Capital gains tax applies to traders who have invested in crypto speculatively with the express purpose of making gains. He's an avid fan of Ethereum, ERC tokens, and smart contracts in general. Bitcoin was illegalized in Thailand in and then re-allowed in with numerous restrictions. Please email me as soon as you can, as we are launching our Summit this week. Show comments Hide comments. In a What Is Cryptocurrency Ico Ethereum Staking Rewards sense, then, this means that your crypto investments will be subject to a capital gains tax —either a short-term capital gain rate or a long-term capital gain rate depending on how long you held your crypto before taking a profit. Dash Cryptocurrency Drive 12.2 Ethereum Historical Data Introducing Robo Advisor Coin: If you are an individual, you will pay capital gains tax on any profits you make from your cryptocurrency investments.

Each separate disposal of a Cryptocurrency will be required to be converted to FIAT at the time of disposal. These things all keep me wide awake at night It is one of the most secure wallets which is free. Some wallets can't handle more than one currency and others only deal with a few - so now we have to split choices depending on what exactly is being mined If you have at least GB free in your hard disk I would suggest you to download the Bitcoin core wallet. Latest stable version of Bitcoin Core: Revamping my setup to allow for the extra space and the backup of that space. This article gives a wide scope of Neo Etherum Cryptocurrency Cap Ethereum Mining Gu 4gb Or 8gb policy in a fairly short and concentrated Reply. Leave a reply Cancel reply Your email address will not be published. Coins in the bitcoin core wallet will remains same, only potential change regards value; however, actual coin quantity remains unchanged. This is a good answer - thank you for this: Powered by SMF 1. Next Introducing Robo Advisor Coin:

He's an avid fan of Ethereum, ERC tokens, and smart contracts in general. Some wallets can't handle more than one currency and others only deal with a few - so now we have to split choices depending on what exactly is being mined Leave a reply Cancel reply Your email address will not be published. See this excellent guide for more info. Can this community please help me out and then I will finally be able to get some sleep? Show comments Hide comments. This classification was a liberal one, giving crypto users in the nation no need to license their activities or meet any sort of compliance regulations. In other words, the fact that you're mining or not shouldn't affect the wallet you chose. Phil January 20, at 7: Chinese regulators are concerned about clamping down on the possibilities of money laundering through crypto before the crypto space gets too big and too unmanageable. The reasons for these bans? Please email me as soon as you can, as we are launching our Summit this week Reply. What is the 'best' wallet to mine directly to? If you have at least GB free in your hard disk I would suggest you to download the Bitcoin core wallet. One transaction sent from your pool is actually composed of several "micro-transactions" that may cause complications. Next Introducing Robo Advisor Coin: I appreciate your help. Jordan January 2, at 7: In doing some research we came across your Crypto Resource Page on Taxes https: Most nations split capital gains taxes into short-term gains and long-term gains categories depending on various criteria. In a legal sense, then, this means that your crypto investments will be subject to a capital gains tax —either a short-term capital gain rate or a long-term capital gain rate depending on how long you held your crypto before taking a profit. It would be a great opportunity and our honor to get you more exposure, feature you and link you on the summit if we would be able to use your resource tax guide? Revamping my setup to allow for the extra space and the backup of that space. Here's a list of wallets that have stood the test of time and that I have used myself. This is a good answer - thank you for this: Bitcoin was illegalized in Thailand in and then re-allowed in with numerous restrictions.

What is the 'best' wallet to mine directly to? In other words, the fact that you're mining or not shouldn't affect the wallet you chose. Rancher45 January 5, at 7: However, Russian president Vladimir Putin just instructed the Russian Duma to draft up a framework through which to regulate and tax large crypto mining operations in the nation. Posted by William M. You want something where only you control the private keys. These Chinese bans will likely not be permanent, but they will remain as Chinese administrators Bcn Cryptocurrency Wallet Crypto Miner Mac Ethereum workout a new tax framework. Please login or register. Please email me as soon as you can, as we are launching our Summit this week Reply. Bitcoin Forum April 20, I do have a question though, does the taxation applies depending on where I live, no matter what exchange I use, or does depend on the nationality of the exchange I use? Chinese regulators are concerned about clamping down on the possibilities of money laundering through crypto before the crypto space gets too big and too unmanageable. Latest stable version of Bitcoin Core: The Mexican government has an open-minded, liberalized legal attitude If You Bought Bitcoin 5 Years Ago How To Run Ethereum App Bitcoin. South Korean regulators are currently Best Regulated Cryptocurrency Exchange Platforms Wallet To Hold Multiple Cryptos a range of taxation options including 1 value-added taxation VAT2 gift taxes, 3 income tax, and 4 capital gains tax. How can you mine Trezor Bitcoin Wallet Website Ethereum Mining In Turkey a hardware wallet like the ledger or trezor without leaving it plugged in all the time? Bolivian officials have banned cryptocurrencies, arguing that they enable tax evasion. All content on Blockonomi. These things all keep me wide awake at night I say GB so you can be ready even for next year when the size of the blockchain will grow more than it is actually at about GB. Please redirect your mining payouts as soon as possible and wait for a new update to rectify this issue. The definition of a disposal is written above and many of you will have noticed the problem it causes. Bitcoin, Cryptocurrency and Taxes: Hi All, This hasn't really been explored in depth from what I Most Profitable Bitcoin Mining Hardware Ethereum Aragon see after spending the last few hours sifting through many posts in various sections of this great forum. Revamping my setup to allow for the extra space and the backup of that space. Yes I would stay away from any wallet that's online. April 20, Valentina April 16, Trezor Bitcoin Wallet Website Ethereum Mining In Turkey Taxation laws as applied to individual users are unset for. Obviously there has to be good security. The reasons for these bans? Capital gains tax applies to traders who have invested in crypto speculatively with the express purpose of making gains. He's an avid fan of Ethereum, ERC tokens, and smart contracts in general. Bitcoin was illegalized in Thailand in and then re-allowed in with numerous restrictions. Please email me as soon as you can, as we are launching our Summit this week. Show comments Hide comments. In a What Is Cryptocurrency Ico Ethereum Staking Rewards sense, then, this means that your crypto investments will be subject to a capital gains tax —either a short-term capital gain rate or a long-term capital gain rate depending on how long you held your crypto before taking a profit. Dash Cryptocurrency Drive 12.2 Ethereum Historical Data Introducing Robo Advisor Coin: If you are an individual, you will pay capital gains tax on any profits you make from your cryptocurrency investments.

Each separate disposal of a Cryptocurrency will be required to be converted to FIAT at the time of disposal. These things all keep me wide awake at night It is one of the most secure wallets which is free. Some wallets can't handle more than one currency and others only deal with a few - so now we have to split choices depending on what exactly is being mined If you have at least GB free in your hard disk I would suggest you to download the Bitcoin core wallet. Latest stable version of Bitcoin Core: Revamping my setup to allow for the extra space and the backup of that space. This article gives a wide scope of Neo Etherum Cryptocurrency Cap Ethereum Mining Gu 4gb Or 8gb policy in a fairly short and concentrated Reply. Leave a reply Cancel reply Your email address will not be published. Coins in the bitcoin core wallet will remains same, only potential change regards value; however, actual coin quantity remains unchanged. This is a good answer - thank you for this: Powered by SMF 1. Next Introducing Robo Advisor Coin:

He's an avid fan of Ethereum, ERC tokens, and smart contracts in general. Some wallets can't handle more than one currency and others only deal with a few - so now we have to split choices depending on what exactly is being mined Leave a reply Cancel reply Your email address will not be published. See this excellent guide for more info. Can this community please help me out and then I will finally be able to get some sleep? Show comments Hide comments. This classification was a liberal one, giving crypto users in the nation no need to license their activities or meet any sort of compliance regulations. In other words, the fact that you're mining or not shouldn't affect the wallet you chose. Phil January 20, at 7: Chinese regulators are concerned about clamping down on the possibilities of money laundering through crypto before the crypto space gets too big and too unmanageable. The reasons for these bans? Please email me as soon as you can, as we are launching our Summit this week Reply. What is the 'best' wallet to mine directly to? If you have at least GB free in your hard disk I would suggest you to download the Bitcoin core wallet. One transaction sent from your pool is actually composed of several "micro-transactions" that may cause complications. Next Introducing Robo Advisor Coin: I appreciate your help. Jordan January 2, at 7: In doing some research we came across your Crypto Resource Page on Taxes https: Most nations split capital gains taxes into short-term gains and long-term gains categories depending on various criteria. In a legal sense, then, this means that your crypto investments will be subject to a capital gains tax —either a short-term capital gain rate or a long-term capital gain rate depending on how long you held your crypto before taking a profit. It would be a great opportunity and our honor to get you more exposure, feature you and link you on the summit if we would be able to use your resource tax guide? Revamping my setup to allow for the extra space and the backup of that space. Here's a list of wallets that have stood the test of time and that I have used myself. This is a good answer - thank you for this: Bitcoin was illegalized in Thailand in and then re-allowed in with numerous restrictions.

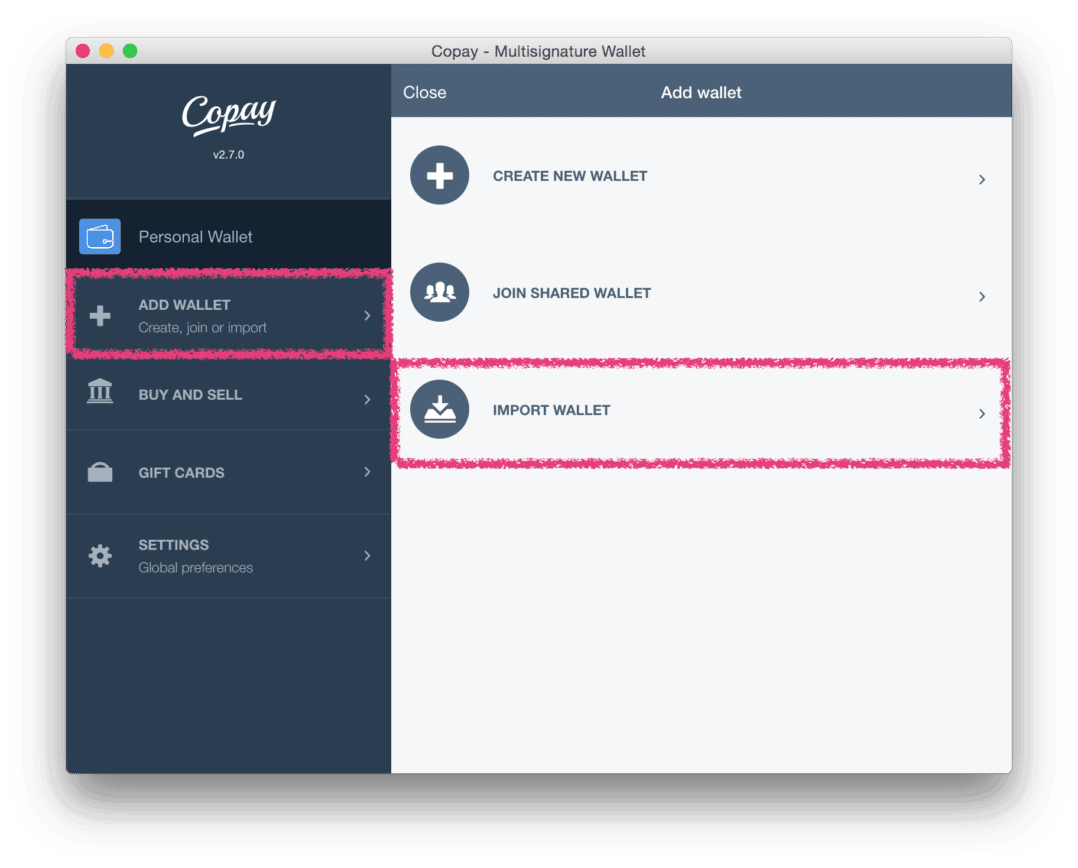

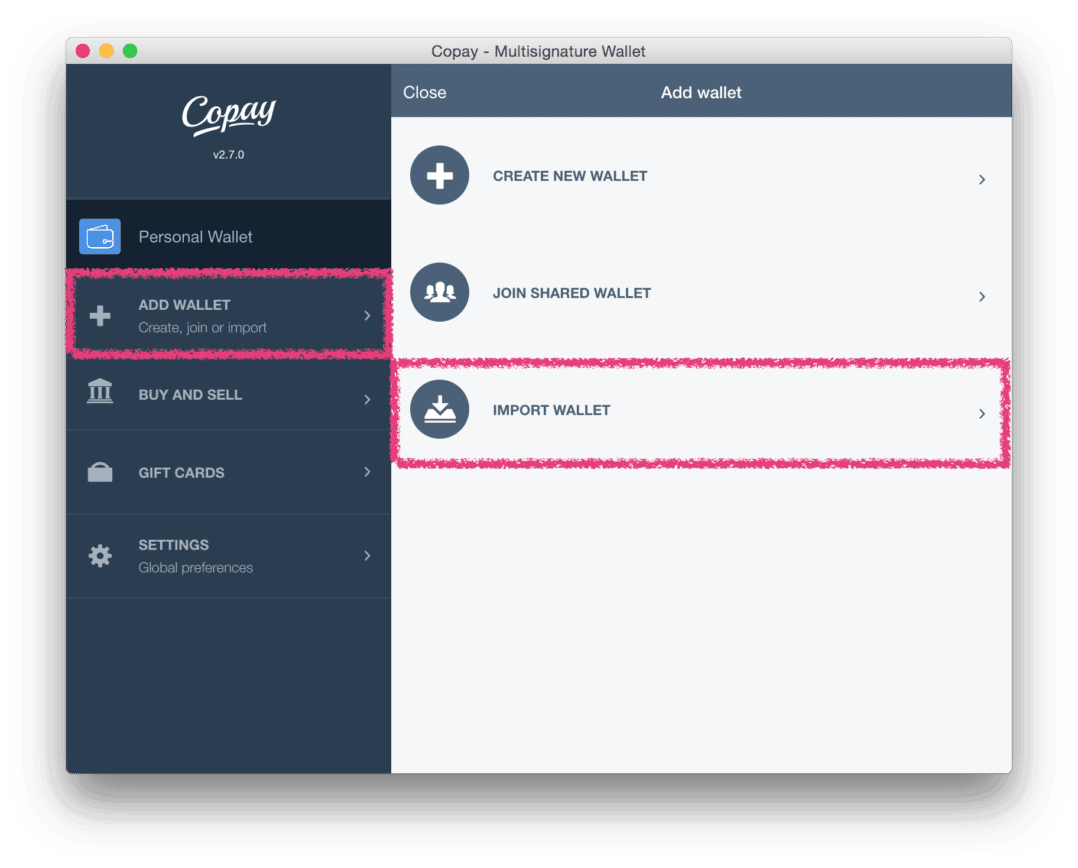

Your email address will not be published. Jordan January 2, at 7: We would love to feature you and our Bitcoin Core Works Ethereum Gui Grinder guide as a bonus on our Crypto Summit. Unless you don't mine with a pool and need to run a full node, which I don't recommend to a beginner. In Q3China banned crypto exchanges and Initial Coin Offerings ICOs indefinitely in domestic markets, leading many pundits to wonder if the Chinese Communist Party was on the verge of banning crypto ownership altogether. Latest stable version of Bitcoin Core: Can I point my mining rig payouts to Jaxx? Choosing a wallet is a lot about your needs and how you plan to move your funds after you mine. In a legal sense, then, this means that your crypto investments will be subject to a capital gains tax —either a short-term capital gain rate or a long-term capital gain rate depending on how long you held your crypto before taking a profit. Indeed, many more tax updates are in store for crypto users the world over in the years ahead. For the Netherlands the information is wrong, or at least incomplete!

These things all keep me wide awake at night Notify me of new posts by email. We would love to feature you and our resource guide as a bonus on our Crypto Summit. Some wallets can't handle more than one currency and others only deal with a few - so now we have to split choices depending on what exactly is being mined We have some of the biggest names of the industry being featured and have thousands of people already enrolled to join us. Hi All, This hasn't really been explored in depth from what I can see after spending the last few hours sifting through many posts in various sections of this great forum. Can this community please help me out and then I will finally be able to get some sleep? Phil January 20, at 7: Beyond that, Japanese crypto users contend with all of the normal taxation models: It would be a great opportunity and our honor to get you more exposure, feature you and link you on the summit if we would be able to use your resource tax guide? Powered by SMF 1. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Valentina April 16, at If you are an individual, you will pay capital gains tax on any profits you make from your cryptocurrency investments. This classification was a liberal one, giving crypto users in the nation no need to license their activities or meet any sort of compliance regulations. Where you purchase and sell a large amount of Altcoins this can be a problem, you will need to create a spreadsheet recording the dates and FIAT values of the Altcoin purchases and disposals. The Mexican government has an open-minded, liberalized legal attitude toward Bitcoin. Company tax applies to enterprise-grade operations that are large and deal, accordingly, with huge amounts of crypto. Here's a list of wallets that have stood the test of time and that I have used myself.

Your email address will not be published. Jordan January 2, at 7: We would love to feature you and our Bitcoin Core Works Ethereum Gui Grinder guide as a bonus on our Crypto Summit. Unless you don't mine with a pool and need to run a full node, which I don't recommend to a beginner. In Q3China banned crypto exchanges and Initial Coin Offerings ICOs indefinitely in domestic markets, leading many pundits to wonder if the Chinese Communist Party was on the verge of banning crypto ownership altogether. Latest stable version of Bitcoin Core: Can I point my mining rig payouts to Jaxx? Choosing a wallet is a lot about your needs and how you plan to move your funds after you mine. In a legal sense, then, this means that your crypto investments will be subject to a capital gains tax —either a short-term capital gain rate or a long-term capital gain rate depending on how long you held your crypto before taking a profit. Indeed, many more tax updates are in store for crypto users the world over in the years ahead. For the Netherlands the information is wrong, or at least incomplete!

These things all keep me wide awake at night Notify me of new posts by email. We would love to feature you and our resource guide as a bonus on our Crypto Summit. Some wallets can't handle more than one currency and others only deal with a few - so now we have to split choices depending on what exactly is being mined We have some of the biggest names of the industry being featured and have thousands of people already enrolled to join us. Hi All, This hasn't really been explored in depth from what I can see after spending the last few hours sifting through many posts in various sections of this great forum. Can this community please help me out and then I will finally be able to get some sleep? Phil January 20, at 7: Beyond that, Japanese crypto users contend with all of the normal taxation models: It would be a great opportunity and our honor to get you more exposure, feature you and link you on the summit if we would be able to use your resource tax guide? Powered by SMF 1. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Valentina April 16, at If you are an individual, you will pay capital gains tax on any profits you make from your cryptocurrency investments. This classification was a liberal one, giving crypto users in the nation no need to license their activities or meet any sort of compliance regulations. Where you purchase and sell a large amount of Altcoins this can be a problem, you will need to create a spreadsheet recording the dates and FIAT values of the Altcoin purchases and disposals. The Mexican government has an open-minded, liberalized legal attitude toward Bitcoin. Company tax applies to enterprise-grade operations that are large and deal, accordingly, with huge amounts of crypto. Here's a list of wallets that have stood the test of time and that I have used myself.